We believe the future of rehabilitation can be enjoyable and accessible!

Design Tools

Catch22 is a UK-based social business working at the intersection of social care, justice, and community services. Their mission is to design and deliver services that build resilience, support communities, and create better futures for individuals facing social challenges.

Crime Happens

Arrest and Police Action

Sentencing

Decision to Prosecute

Serving the Sentence

Court Proceedings

Rehabilitation and Reintegration

Victim Services

Dependency and Recovery

Crime Diversion

1:1 Support Sessions

Gangs

HMP Thameside Offender Management

Rehabilitation and Reintegration

Offender Management and Rehabilitation

Finance, Benefit and Debt

Group Intervention

Session Delivery

Overview of Topics

60 - 90 min

In person

Avg. 2-5 participants / 2 practitioners

Participants engage in discussions, reflective exercises, and practical tasks

Mastering Money for a Better Future

From Debt to Financial Stability

Small Steps, Big Savings

The goal is for participants to leave with practical tools, increased confidence, and a clear plan to improve their financial stability.

Practitioner

Sarah Thompson

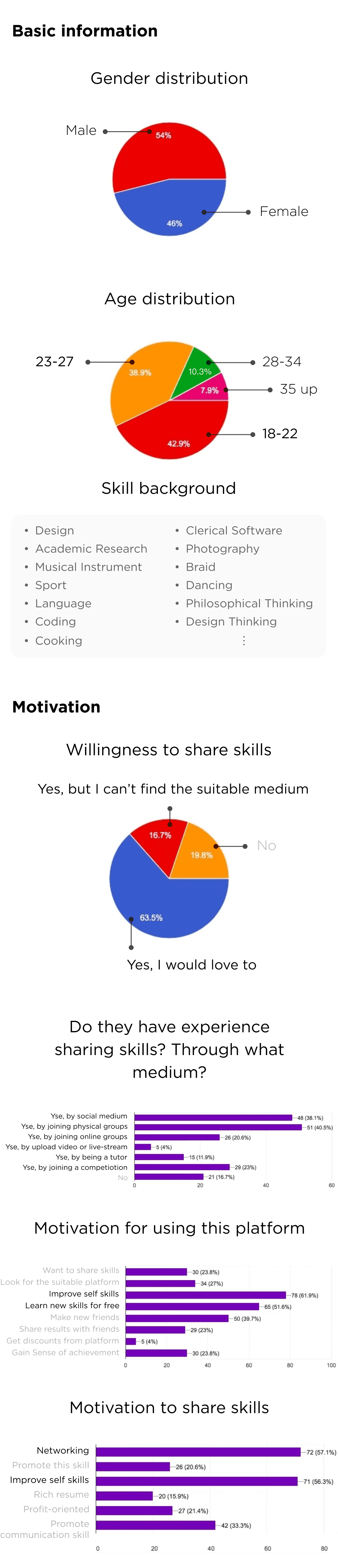

Personal Information

Age: 25

Status: Practitioner in Catch22

Personality:

Empathetic, patient, and approachable

Passionate about helping others grow and develop

Challenges

Struggles with participants who don’t engage

Needs materials that resonate with everyone in the group

Lacks consistent practice due to less frequent group interventions

Probationer

Alex Carter

Personal Information

Age: 31

Status: On probation after a non-violent offence

Personality:

Opens up when respected and given trust

Goal-oriented with a sharp sense of humor

Confident with technology and social media

Needs

A structured and supportive environment to excel

Direct, clear information that empowers decision-making

Recognition and rewards for progress and growth

Activities that challenge him mentally and physically, with a hint of humor

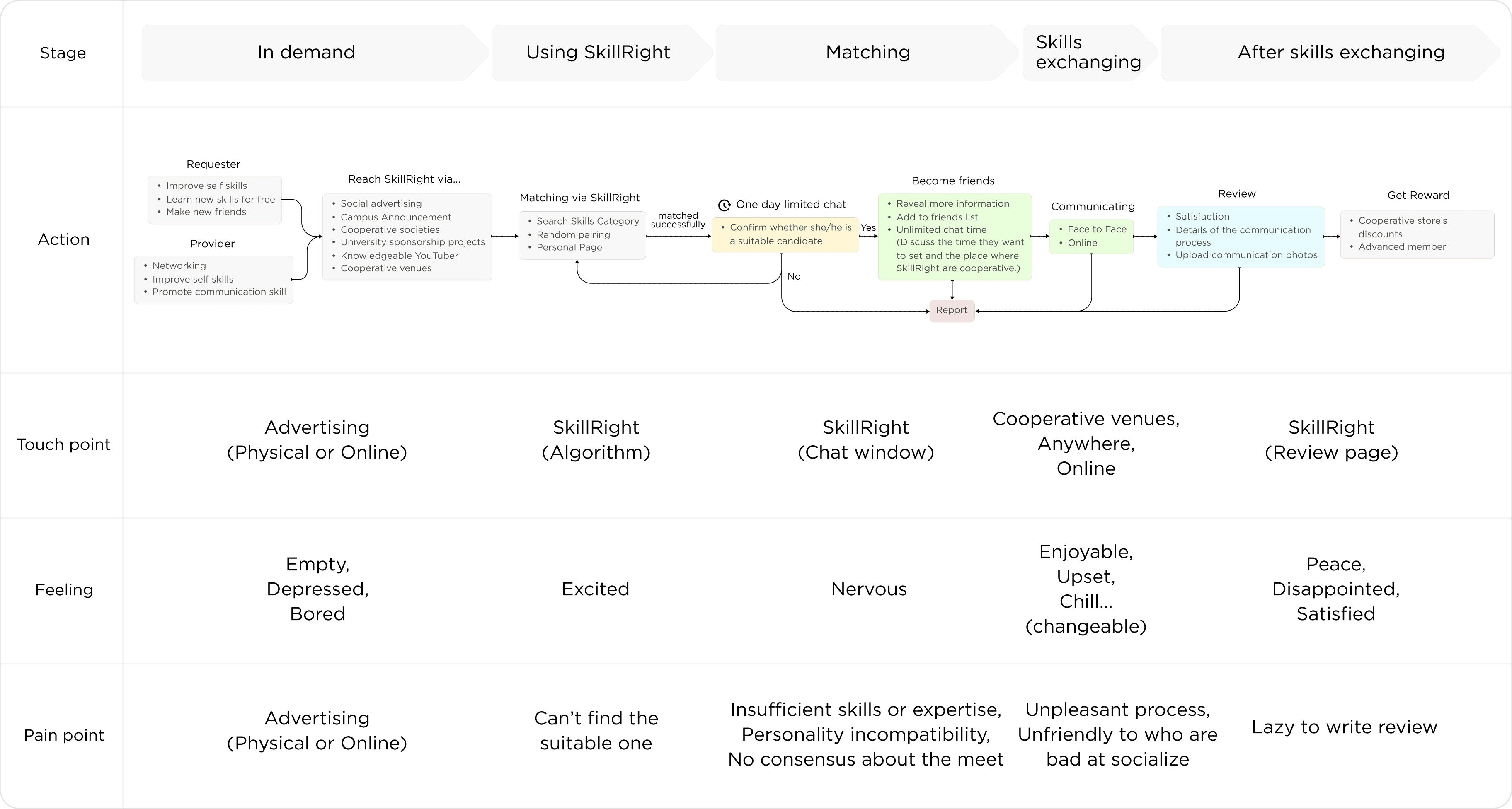

Assessment

Grouping

Meet the facilitators

Financial Courses

Wellbeing and Mental Fitness Courses

Supplement Interventions Courses

Individualised Support

Leave

assess their needs and direct them to appropriate services

Staffs are grouped them according to background, about 5 participants per group

Meet the facilitators before the programme starts (in person or via phone)

Basics of finance, general sources of income, social benefits, tax credits, saving money, borrowing money and debt, spending money, budgeting, etc.

Communication, Anxiety, Assertiveness, Stress, Problem Solving, Goal Setting, and Workbooks.

with partner organisation Barclays--Essential Digital Skills: Transacting, Life Skills: Confidence in Money

Financial support and advocacy, Appealing benefits entitlement decisions, Discretionary housing payment, Managing court fines , Dealing with and managing debts

Stigma

Participants feel judged or ashamed discussing financial challenges, hindering trust and communication.

Lack of Openness

Fear of criticism limits honest conversations and meaningful connections in group sessions.

Low Engagement

Sessions lack interactive activities, reducing motivation and active participation.

Lack of Incentives

Absence of meaningful rewards discourages sustained interest and commitment.

How might we encourage open, stigma-free conversations about finances and debt through engaging group icebreakers?

How might we use online platforms for stakeholders to share financial insights and promote Catch22’s service?

How might we design a reward system that motivates active engagement by emphasizing employability and skills, not probation status?

Meeting with Catch22

Understanding

the assessment & course processes

We had more comprehensive understanding of the assessment and course processes after 3-4 meetings.

Workshop with Inhouse Records

Insights & Challenges

We knew what are their motivations, biggest challenges during probation, and preferred ways to learn financial knowledge. Throughout these meetings, we figured out 3 strategies.

Show our strategies to Catch22

Prototype Feedback

Finally, we presented the prototype to catch22 and received very positive feedback.

Assessment

Grouping

Meet the facilitators

Financial Courses

Wellbeing and Mental Fitness Courses

Supplement Interventions Courses

Individualised Support

Leave

assess their needs and direct them to appropriate services

Staffs are grouped them according to background, about 5 participants per group

Meet the facilitators before the programme starts (in person or via phone)

Basics of finance, general sources of income, social benefits, tax credits, saving money, borrowing money and debt, spending money, budgeting, etc.

Communication, Anxiety, Assertiveness, Stress, Problem Solving, Goal Setting, and Workbooks.

with partner organisation Barclays--Essential Digital Skills: Transacting, Life Skills: Confidence in Money

Financial support and advocacy, Appealing benefits entitlement decisions, Discretionary housing payment, Managing court fines , Dealing with and managing debts

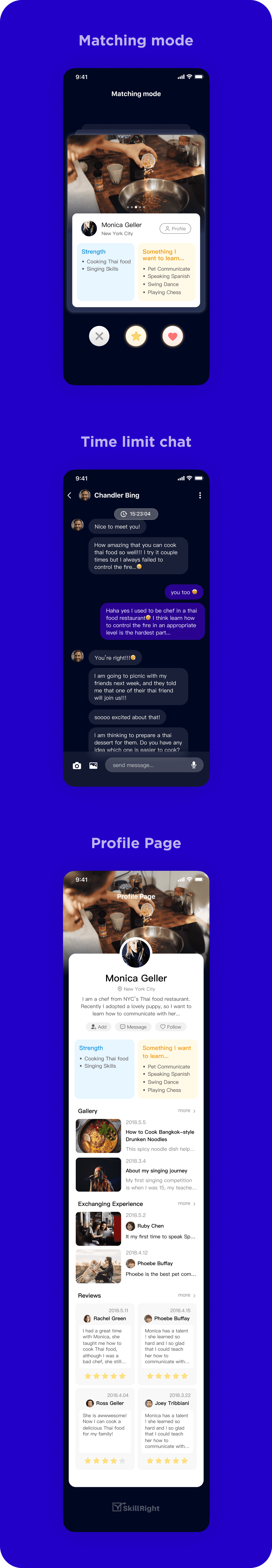

O’Snap Card Game

Online Resources

Reward System

As an icebreaker role, it breaks stigma and builds trust.

Accessible learning beyond offline consultation

Before

During

After

Grouping Method

Interactive & Hands-on Learning for Group Sessions

O’Snap Card Game

Short-term & Personalized Rewards

Online learning & resource

Long-term Rewards